mississippi state income tax calculator

Real property tax on median. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

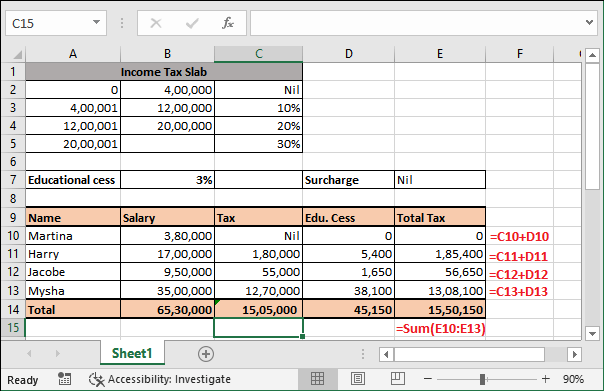

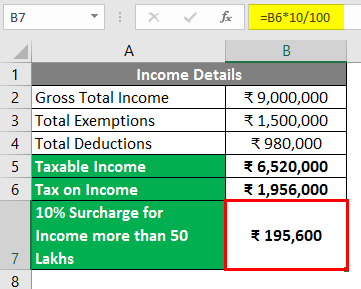

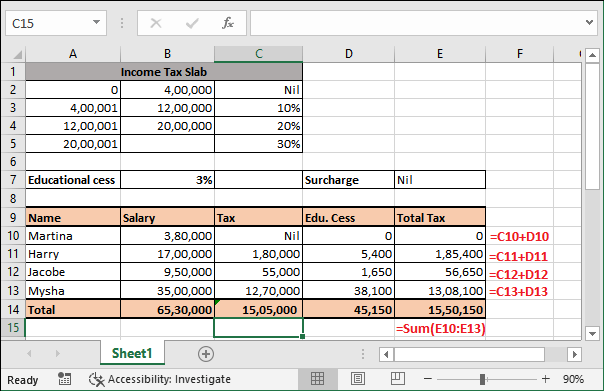

Income Tax Calculation Formula With If Statement In Excel

As we discussed before Mississippi uses a graduated system to structure their state taxes.

. You can calculate how much your monthly mortgage payment is with PMI property tax insurance and HOA if applicable using the Mississippi Mortgage Calculator. Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on. The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses.

Mississippi Income Tax Calculator 2021. If you are receiving a refund. Mississippi Income Tax Forms.

Were proud to provide one of the most comprehensive free online tax calculators to our users. The tax rates are as follows. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223.

Sales Tax State Local Sales Tax on Food. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Mississippi Hourly Paycheck Calculator.

Check the 2018 mississippi state tax rate and the rules to calculate. Mississippi sales tax rate. Details on how to.

The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Mississippi. Filing 5000000 of earnings will result in 178500 of your earnings being taxed as state tax calculation based on 2022 Mississippi State Tax Tables. Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4.

You will be taxed 3 on any earnings between 3000. There is no tax schedule for mississippi income taxes. Mississippi Salary Tax Calculator for the Tax Year 202223.

Calculate Mississippi State Income Tax Manually. 0 on the first 2000 of taxable income. Mississippi does allow certain deduction amounts depending upon your filing status.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. Married Filing Joint or.

You can use this tax calculator. The Mississippi income tax calculator is designed to provide a salary example with salary deductions made in. Mississippi residents have to pay a sales tax on goods and services.

Your average tax rate is 1198 and your marginal tax rate. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

The Mississippi State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Mississippi State Tax CalculatorWe also. This results in roughly 9851 of. If you like to calcualte state tax withholdings manually you can refer to the Mississippi tax tables and step by step guide there.

Below is listed a chart of all the exemptions allowed for Mississippi Income Tax. The mississippi salary calculator is a good calculator for calculating your total salary deductions each year this includes federal income tax rates and thresholds in 2022 and mississippi state. The 2022 state personal income tax.

The MS Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MSS. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Mississippi State Tax Quick.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The Mississippi tax calculator is updated for the 202223 tax year. Our income tax and paycheck calculator can help you understand your take home pay.

The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. All other income tax returns. If you make 199000 in Mississippi what will your salary after tax be.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. The rates range from 0-5 and are based on the taxpayers adjusted gross income AGI. Mississippi Salary Paycheck Calculator.

Your household income location filing status and number of personal exemptions. Mississippis sales tax rate consists of a state tax 7 percent and local.

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax Calculation Formula With If Statement In Excel

How To Calculate Income Tax In Excel

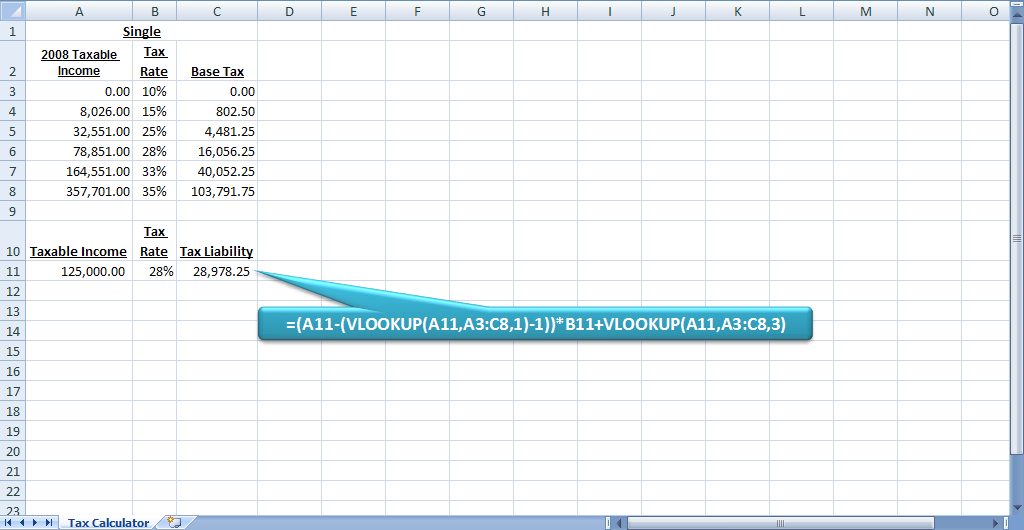

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Mississippi Income Tax Calculator Smartasset

Income Tax Calculating Formula In Excel Javatpoint

Mississippi Tax Rate H R Block

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculator 2021 2022 Estimate Return Refund

Mississippi Tax Rate H R Block

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc